Share This Post

Imagine this: It’s Friday afternoon, and you’re eagerly awaiting your paycheck. You log into your company’s payroll system, only to find a confusing mess of numbers and no clear explanation of your deductions. Sound familiar?

Let’s be honest: It shouldn’t be anymore.

For most employees nowadays, payroll isn’t just about receiving money – it’s about peace of mind, financial planning, and feeling valued by their employer. Let’s dive into what today’s workforce really wants from their payroll experience.

At its core, payroll focuses on getting people paid correctly and on time. Seems simple, right? Yet, the impact of this fundamental aspect cannot be overstated.

For employees, a reliable pay schedule goes beyond just convenience. It’s their cornerstone of financial stability. Late payments can cascade into missed bill payments, overdraft fees, and unnecessary stress. Similarly, payroll errors, even minor ones, can erode trust between employees and employers.

Modern payroll systems are addressing these concerns by implementing robust error-checking mechanisms and automated scheduling. But for employees, the real game-changer is transparency.

Gone are the days when employees were content with a lump sum appearing in their bank account. Today’s workforce wants to understand their earnings inside and out. This means:

Transparency in payroll also must be more than just about satisfying curiosity. It requires empowering employees to make informed financial decisions. When workers can easily see how much they’re contributing to their 401(k) or how much is being set aside for health insurance, they’re better equipped to manage their overall financial health.

As digital solutions become ubiquitous in the workplace, employees expect information at their fingertips – and payroll data is no exception. The ability to access pay stubs, tax forms, and historical payroll information 24/7 is becoming less of a luxury and more of a standard expectation.

Mobile-friendly platforms are particularly crucial. Whether an employee needs to reference their earnings while applying for a loan or wants to check their vacation day balance while planning a trip, the ability to access this information from a smartphone can make a world of difference.

For employees who frequently incur work-related expenses, the reimbursement process can be a major pain point. Modern payroll systems are addressing this by:

By simplifying this process, employers show that they value their employees’ time and financial well-being.

In an era of increasing cyber threats, employees are understandably concerned about the security of their personal and financial information. They expect payroll systems to have:

Employees want to know that their sensitive information is protected, and that they have control over who can access it.

While automation and self-service features are convenient, employees still value human support when it comes to payroll issues. The ideal payroll system balances digital efficiency with accessible, knowledgeable support staff who can address complex questions or concerns.

Quick response times and the ability to speak with a real person when needed can significantly enhance employee satisfaction with payroll processes.

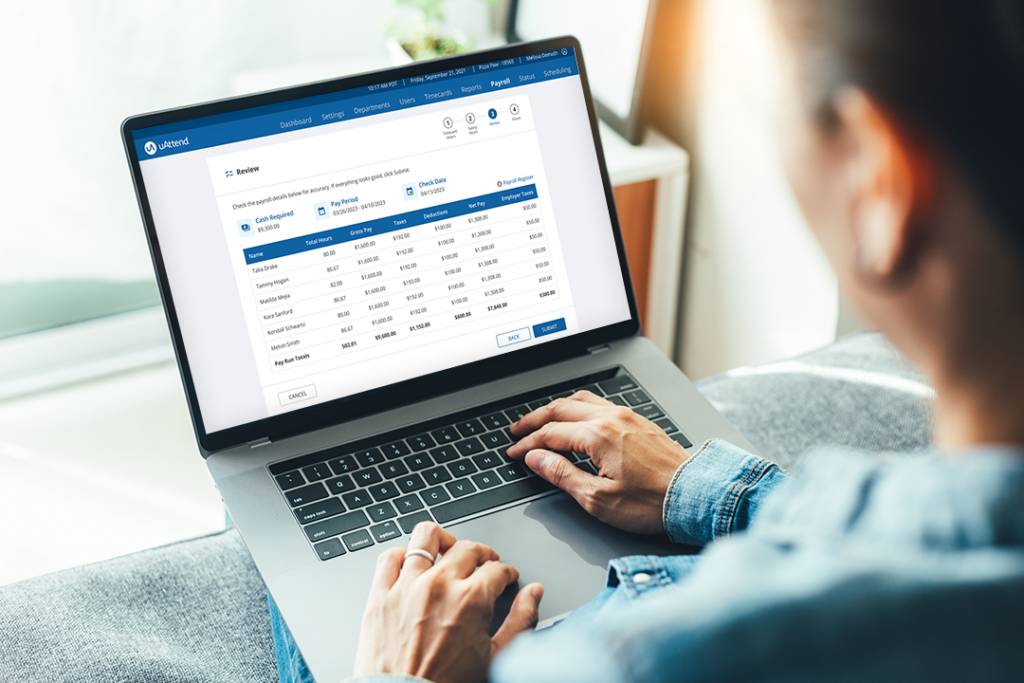

Today’s employees expect more from their payroll experience than just a regular deposit. They want transparency, accessibility, financial empowerment, and security. uAttend is leading the way for modern payroll systems that are rising to meet these expectations, transforming payroll from a basic business function into a comprehensive tool for employee financial well-being.

By prioritizing these employee-centric features, businesses can use their payroll system as a powerful tool for attracting and retaining talent. After all, when employees feel confident and in control of their earnings, they’re more likely to be engaged, productive, and loyal to their employer.

In the end, an effective payroll system should do far more than just pay employees. It must also demonstrate that your company values its workforce and is invested in their financial success. That’s something every employee can appreciate.

CUSTOMER SERVICE

CUSTOMER SERVICE

© 2025 Workwell™ Technologies, All Rights Reserved.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Form submission will redirect you to our calendar

where you can schedule a free demo.