Share This Post

Tired of spending countless hours processing payroll every pay period? If you touch or oversee the payroll process in any way, you understand the importance of efficient payroll management. However, manual calculations, data entry, and compliance checks can be time-consuming and prone to errors. Let’s explore practical steps you can take to significantly reduce the time and effort involved in payroll processing.

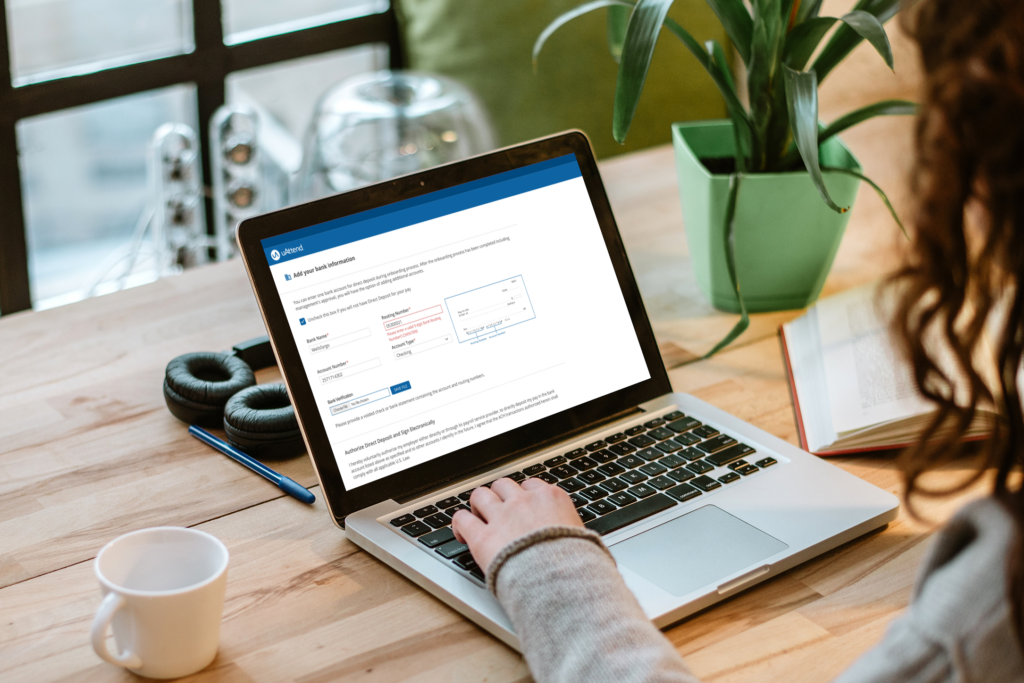

Efficient payroll starts with smooth employee onboarding. Implement a system that allows new hires to self-onboard by providing their personal information, tax details, and direct deposit preferences. uAttend Payroll offers an intuitive onboarding process that saves HR time and ensures accurate data collection from the start.

Instead of manually collecting and entering employee information, an HR team can send out self-onboarding invitations through uAttend Payroll. New hires complete their profiles, provide necessary documents, and set up direct deposit preferences, all before their first day. This streamlined process saves HR countless hours and ensures that new employees are set up correctly in the payroll system from day one.

What this delivers:

Create clear and concise payroll policies that outline pay schedules, timesheet submission deadlines, and approval processes. Communicate these policies effectively to your employees and managers. When everyone understands their responsibilities and deadlines, it reduces delays and errors in the payroll process.

Consider a healthcare clinic struggling with late timesheet submissions and last-minute changes. This leads to payroll delays and frustrated employees. By establishing and communicating clear payroll policies, such as a strict timesheet submission deadline and a defined approval process, the clinic can ensure timely and accurate payroll processing. Managers and employees are held accountable, and the payroll team can work efficiently without constant interruptions.

You can expect:

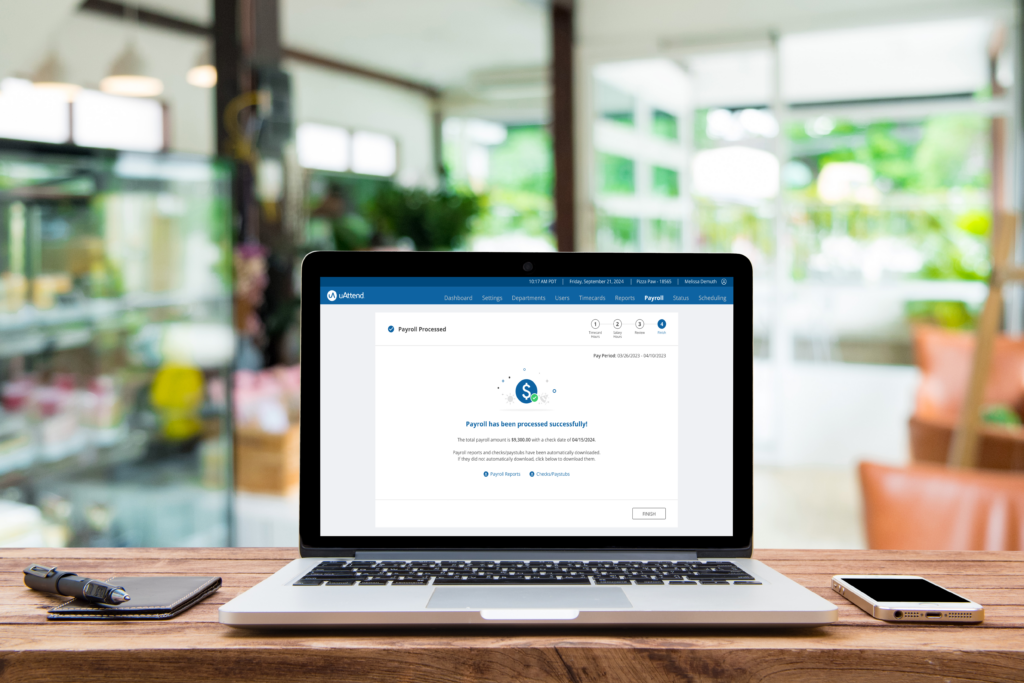

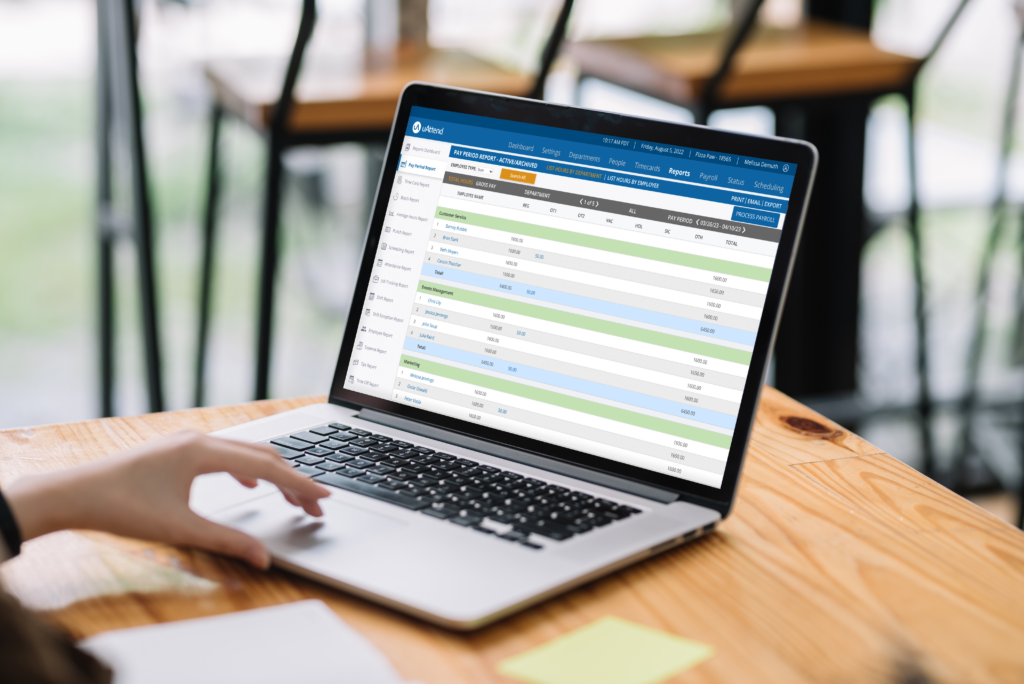

Generating payroll reports manually can be a time-consuming task. Look for a payroll software that offers automated reporting features. uAttend Payroll provides quick insight reports on pay, taxes, deductions, and more. These reports can be easily downloaded and used for accounting and compliance purposes, saving you valuable time.

Every quarter, finance teams devote hours compiling payroll data for tax purposes and financial reporting. With uAttend Payroll’s automated reporting feature, the team can generate comprehensive reports with just a few clicks. They can quickly access pay summaries, tax liabilities, and deduction details, all in a format that’s ready for further analysis or submission to others who need it.

How this helps you:

Empower your employees to access their pay information, update personal details, and view pay stubs through a self-service portal. uAttend Payroll provides access for employees to view their pay history, tax documents, and even W-2s. This not only saves time for HR but also improves employee satisfaction and reduces queries.

With this system, employees even across multiple locations can receive numerous requests from employees for pay stubs and tax documents. By providing employee self-service through uAttend Payroll, staff can access their information anytime, anywhere. They can view and download pay stubs, update their contact details, and even access W-2s come tax season. This self-service approach reduces the workload on HR and empowers employees to take control of their pay information.

How you benefit:

CUSTOMER SERVICE

CUSTOMER SERVICE

© 2025 Workwell™ Technologies, All Rights Reserved.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Form submission will redirect you to our calendar

where you can schedule a free demo.